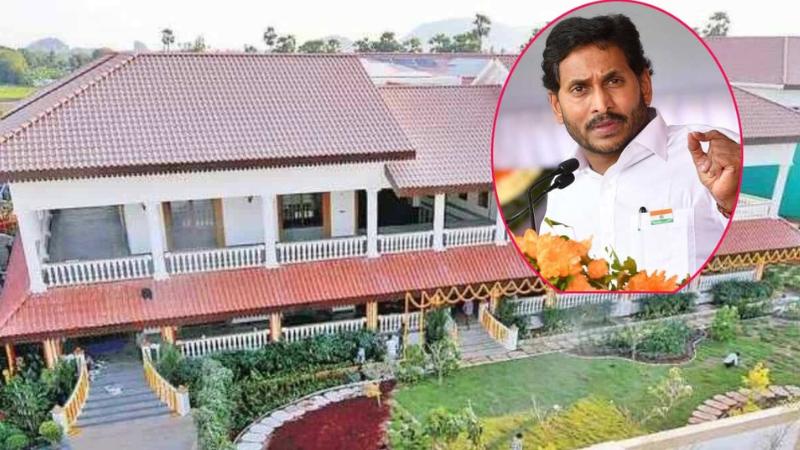

YS Jagan Mohan Reddy Makes Vaastu Changes to His Residence After Election Loss

YS Jagan Mohan Reddy, the MLA from Pulivendula and president of YSR Congress, has been spending much of his time in Bengaluru since the recent 2024 Andhra Pradesh elections. While in Bengaluru, he stays at his Yelahanka Palace but frequently visits Andhra Pradesh for a few days each week. Reports have surfaced suggesting that significant Vaastu changes are being made to his Tadepalli residence and camp office following the party's historic defeat in the elections. Social media h

YS Jagan Mohan Reddy Makes Vaastu Changes to His Residence After Election Loss

YS Jagan Mohan Reddy, the MLA from Pulivendula and president of YSR Congress, has been spending much of his time in Bengaluru since the recent 2024 Andhra Pradesh elections. While in Bengaluru, he stays at his Yelahanka Palace but frequently visits Andhra Pradesh for a few days each week. Reports have surfaced suggesting that significant Vaastu changes are being made to his Tadepalli residence and camp office following the party's historic defeat in the elections. Social media h

Panel Proposes New GST Rates for Sin Goods and Other Adjustments

A panel of state ministers has recommended changes to the Goods and Services Tax (GST) structure, specifically targeting sin goods, including tobacco products, aerated beverages, and luxury cars. These goods are currently taxed at the highest 28% GST rate, along with an additional cess. The proposal, which is part of a rate rationalisation report, is set to be presented before the GST Council in its upcoming meeting later this month. The Group of Ministers (GoM), led by Bihar Deputy Chief Min

Panel Proposes New GST Rates for Sin Goods and Other Adjustments

A panel of state ministers has recommended changes to the Goods and Services Tax (GST) structure, specifically targeting sin goods, including tobacco products, aerated beverages, and luxury cars. These goods are currently taxed at the highest 28% GST rate, along with an additional cess. The proposal, which is part of a rate rationalisation report, is set to be presented before the GST Council in its upcoming meeting later this month. The Group of Ministers (GoM), led by Bihar Deputy Chief Min

President Biden Pardons Son Hunter Biden Amid Legal Challenges

US President Joe Biden announced on Sunday that he had granted a pardon to his son, Hunter Biden, who was convicted of making false statements on a gun background check and illegally possessing a firearm. Hunter Biden had also pled guilty to federal tax charges, admitting to failing to pay $1.4 million in taxes. President Biden expressed that his decision to pardon his son came after years of what he described as unfair, politically motivated prosecution. Biden stated that he had pr

President Biden Pardons Son Hunter Biden Amid Legal Challenges

US President Joe Biden announced on Sunday that he had granted a pardon to his son, Hunter Biden, who was convicted of making false statements on a gun background check and illegally possessing a firearm. Hunter Biden had also pled guilty to federal tax charges, admitting to failing to pay $1.4 million in taxes. President Biden expressed that his decision to pardon his son came after years of what he described as unfair, politically motivated prosecution. Biden stated that he had pr

Finance Ministry to Review Windfall Tax on Fuel Exports as Crude Prices Stabilize

The Finance Ministry is set to review the windfall tax on fuel exports, including petrol, diesel, and Aviation Turbine Fuel (ATF), following the stabilization of global crude oil prices. The tax, introduced in July 2022, was implemented to address the substantial profits earned by oil refiners exporting fuel, which had an impact on domestic supplies. The review will assess the tax’s effectiveness and the revenue it has generated, with the Ministry of Petroleum and Natural Gas already re

Finance Ministry to Review Windfall Tax on Fuel Exports as Crude Prices Stabilize

The Finance Ministry is set to review the windfall tax on fuel exports, including petrol, diesel, and Aviation Turbine Fuel (ATF), following the stabilization of global crude oil prices. The tax, introduced in July 2022, was implemented to address the substantial profits earned by oil refiners exporting fuel, which had an impact on domestic supplies. The review will assess the tax’s effectiveness and the revenue it has generated, with the Ministry of Petroleum and Natural Gas already re

10 Effective Tips to Manage Mental Health During Menopause

Menopause can bring significant hormonal changes that impact mental health, leading to mood swings, anxiety, and other emotional challenges. Here are ten effective strategies to help you navigate this transition and maintain your mental well-being: Exercise Regularly Physical activity boosts endorphins, which enhance mood and reduce stress. Aim for activities like yoga, walking, or swimming to improve overall energy and mental healt

10 Effective Tips to Manage Mental Health During Menopause

Menopause can bring significant hormonal changes that impact mental health, leading to mood swings, anxiety, and other emotional challenges. Here are ten effective strategies to help you navigate this transition and maintain your mental well-being: Exercise Regularly Physical activity boosts endorphins, which enhance mood and reduce stress. Aim for activities like yoga, walking, or swimming to improve overall energy and mental healt

GST Collections Rise 6.5% Year-on-Year to ₹1.73 Lakh Crore in September

In a positive sign for the Indian economy, the Goods and Services Tax (GST) collections for September 2023 increased by 6.5% year-on-year, totaling ₹1.73 lakh crore. This marks a rise from ₹1.63 lakh crore collected in September of the previous year. The net GST collection after refunds stood at ₹1.53 lakh crore, showing a growth of 4% compared to ₹1.47 lakh crore in September 2022. So far this fiscal year, the government has recorded a gross GST revenue of ₹10.87 lakh cro

GST Collections Rise 6.5% Year-on-Year to ₹1.73 Lakh Crore in September

In a positive sign for the Indian economy, the Goods and Services Tax (GST) collections for September 2023 increased by 6.5% year-on-year, totaling ₹1.73 lakh crore. This marks a rise from ₹1.63 lakh crore collected in September of the previous year. The net GST collection after refunds stood at ₹1.53 lakh crore, showing a growth of 4% compared to ₹1.47 lakh crore in September 2022. So far this fiscal year, the government has recorded a gross GST revenue of ₹10.87 lakh cro

GST Council Panel to Review Tax Structure for 100 Items in Goa Meeting

A panel of state ministers, established by the Goods and Services Tax (GST) Council, is set to convene in Goa on September 24 and 25. This six-member group, led by Bihar Deputy Chief Minister Samrat Chaudhary, will review the implications of rate rationalization on at least 100 items. The discussions aim to analyze potential changes in GST slabs and rates, particularly focusing on essential goods. During the two-day meeting, the panel will explore various

GST Council Panel to Review Tax Structure for 100 Items in Goa Meeting

A panel of state ministers, established by the Goods and Services Tax (GST) Council, is set to convene in Goa on September 24 and 25. This six-member group, led by Bihar Deputy Chief Minister Samrat Chaudhary, will review the implications of rate rationalization on at least 100 items. The discussions aim to analyze potential changes in GST slabs and rates, particularly focusing on essential goods. During the two-day meeting, the panel will explore various

Koratala Siva Sparks Debate on Taxpayer Privileges After Airport Incident

Koratala Siva, a renowned filmmaker in the Telugu film industry, recently drew attention with his remarks about taxpayer privileges during a podcast hosted by former IAS officer Jayaprakash Narayanan. Known for his successful directorial career, Siva shared a personal anecdote about an incident at the airport where he felt entitled to special treatment due to his high tax contributions. During the podcast, Siva recounted an experience where, due to a tight schedule,

Koratala Siva Sparks Debate on Taxpayer Privileges After Airport Incident

Koratala Siva, a renowned filmmaker in the Telugu film industry, recently drew attention with his remarks about taxpayer privileges during a podcast hosted by former IAS officer Jayaprakash Narayanan. Known for his successful directorial career, Siva shared a personal anecdote about an incident at the airport where he felt entitled to special treatment due to his high tax contributions. During the podcast, Siva recounted an experience where, due to a tight schedule,